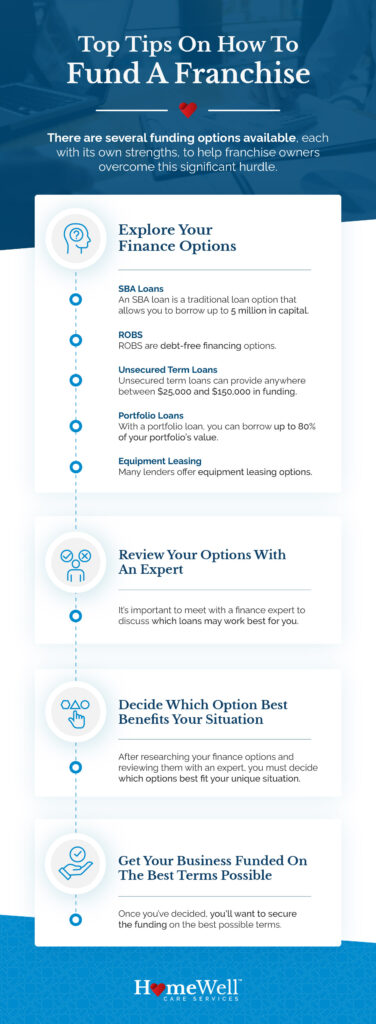

The most common reason franchises fail is a lack of funding. Many franchise owners do not have enough personal funds to put into the business, while others believe that they do not qualify for various loans. In reality, there are several funding options available, each with its own strengths, to help franchise owners overcome this significant hurdle. In order to make the best financial decision for your unique situation, it is important to understand the differences between the many finance options.

In an online seminar with HomeWell Care Services, funding expert Jason Juric offers four practical tips on funding your franchise:

Juric focuses on five main sources during his presentation: Small Business Association (SBA) loans, Rollover For Business Startups (ROBS), unsecured term loans, portfolio loans, and equipment leasing. It’s crucial to research the benefits, restrictions, and requirements for each funding option to decide which one will work best for you.

An SBA loan is a traditional loan option that allows you to borrow up to 5 million in capital. Most loans have a 10-year maximum term and feature a variable rate throughout the duration of the loan. Best of all, SBA loans require minimal collateral, making them a great option for franchise owners who do not have many other assets or need a large amount of funding.

ROBS are debt-free financing options. Rather than borrowing the money from a lender, the money is pulled from your existing retirement funds. These loans enable you to invest up to 100% of your existing retirement funds into a small business with zero tax penalties. If you are hesitant to take out an additional loan and have significant retirement savings, you might consider using ROBS as a funding option.

Unsecured term loans can provide anywhere between $25,000 and $150,000 in funding. These loans typically close at 9% of the loan value, compared to SBA loans which close at 20%. Unsecured loans are available within two weeks and do not require any type of collateral, but they do require the borrower to have a Fico Score of 690 or higher. This is a good option for owners who need a smaller amount of funding in a shorter amount of time; however, interest rates are typically higher than other finance options.

With a portfolio loan, you can borrow up to 80% of your portfolio’s value. There is a flat rate fee of 4%, which can be paid from the loan amount. These loans offer interest rates as low as 3% to 4%, and the funds are available in about 10 days. If you’re self-employed, a real estate investor, own non-conforming properties, or have a non-traditional income stream, this type of loan may be a great option.

If you need to rent equipment for your franchise, many lenders offer equipment leasing options. Interest rates range between 8.5% and 20%, depending on the industry, the type of equipment being rented, and your credit history. The rental period typically lasts between two to five years, during which you’ll pay fixed payments. Leasing can be a good choice if you need equipment for a short time or don’t have the money to buy it.

It’s important to meet with a finance expert to discuss which loans may work best for you. Even if you are confident in your research, talking with an expert provides you with a second opinion, and it allows you to learn more details and restrictions regarding the loans that you may not have known about. Finally, a financial expert can offer professional recommendations, some of which you may not have considered before.

After researching your finance options and reviewing them with an expert, you must decide which options best fit your unique situation. You’ll want to consider interest rates, credit requirements, length of term, and the size of the loan needed when making your decision.

Once you’ve decided, you’ll want to secure the funding on the best possible terms. It’s recommended that you prepare a comprehensive business plan outlining your territory, target market, revenue projections, and potential exit strategy. You’ll also want to keep a financial profile and research various investors. Some finance experts may handle this step for you by contacting various lenders and negotiating on your behalf.

If you are interested in starting your own home care franchise or looking for ways to fund one, we can help. At HomeWell Care Services, we have systems in place that are designed to make the process of opening your home care agency as simple as possible. We even provide you with the franchise training and support you need. Contact us today to learn more. You can also download our franchise kit to learn more details about our process.